Overview: Looking back at 2020, since the impact of public health incidents at the beginning of the year, the tinplate market began to decline from the beginning of the year. From the blocked exports to the sluggish domestic market, the overall market sentiment fell to a very low level. Time advances to May. With the gradual implementation of the policies of the two sessions, market demand has begun to rebound. The futures prices of steel mills led by Baosteel began to increase sharply, and overall market trading began to gradually return to normal. Looking forward to the third quarter, what pattern and trend will the tinplate market show? The following author will elaborate on this in conjunction with the basic situation in the first half of the year.

Review of the tinplate market in the first half of 2020

1. In terms of futures prices:

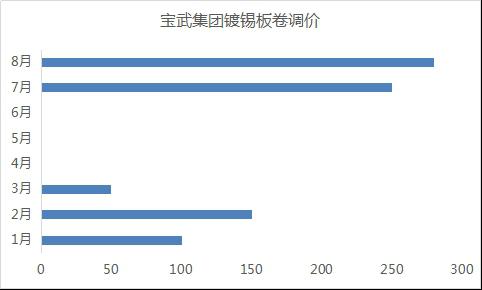

Taking Baowu Group's tin plating price as an example, the adjustment range of its January-August futures price is as follows:

Figure 1: Baowu Group's futures price adjustment unit (yuan/ton) Data source: Steel Union data

It can be seen that futures prices are greatly affected by the epidemic, especially in April-June, the overall price adjustment range is basically zero. In the case of gradually strong demand, it can be seen that the overall futures price is particularly prominent. In July, the price adjustment range of 200 yuan has been exceeded, and the overall futures trend is unusually strong, which also brings certain positive confidence to investors and traders.

2. Import and export:

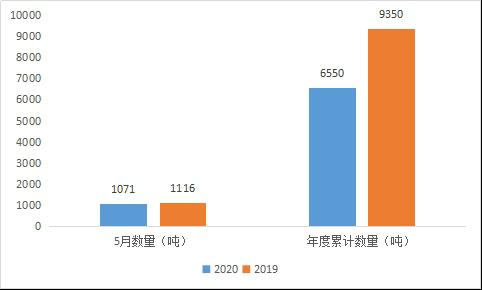

(1) Import:

As of May 2020, the total import volume totaled 6550 tons, a decrease of 29.9% year-on-year. From the perspective of importing countries, major importing countries are still affected by the epidemic, and steel production is subject to certain restrictions. From the perspective of market competition, the tin plating capacity in my country's market is relatively large, and the overall import price is relatively high, so compared to previous years, there has been a certain decline.

Figure 2: Imported quantity units (tons) in May and January-May. Data source: Customs data

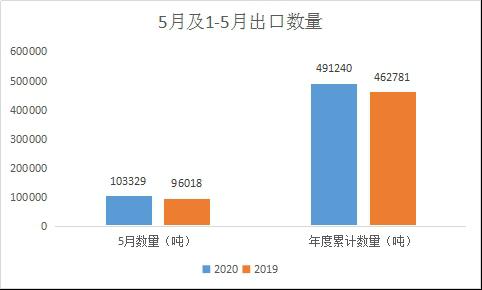

(2) Export:

As of May 2020, total exports in May totaled 103,000 tons, a year-on-year increase of 7.3%. The total export volume totaled 491,000 tons, a year-on-year increase of 6.1%. The reason is that during this period, the epidemic situation in my country has been completely controlled compared with foreign countries, and domestic production lines have basically resumed production, with larger output. Compared with the suspension of foreign production lines, tinplate, as the main raw material for canned goods for daily necessities abroad, is in greater demand, so the export volume has grown faster.

Figure 3: Export quantity units (tons) in May and January-May. Data source: Customs data

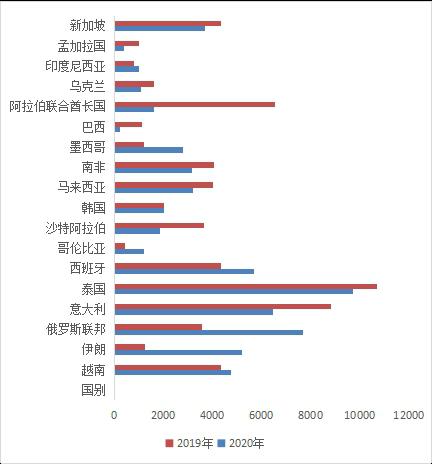

(3) In terms of exporting countries:

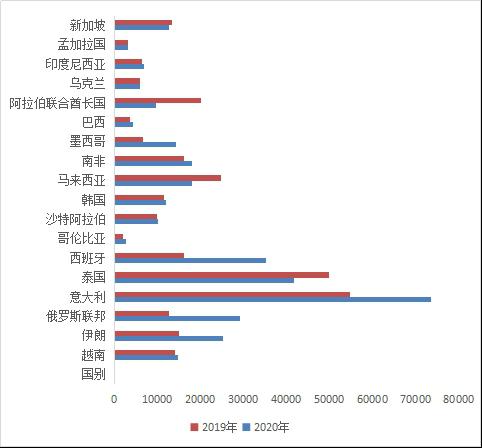

Figure 4: May export statistics by country (tons) Data source: customs data

Figure 5: Export statistics by country from January to May (tons) Data source: Customs data

Judging from the export situation in May, the top three exporting countries are Thailand, Russia, and Italy, while the top three exporting countries are Italy, Thailand, and Spain. According to the exporters' feedback, due to the sudden outbreak of the epidemic in May, Russia's overall tin plating capacity was severely lacking, so a large amount of imports from my country were caused.

3. Tinning production

As of June 30, Mysteel surveyed 23 large-scale tinplate manufacturers in China. The survey data showed that the overall operating rate was 92.16% and the capacity utilization rate was 70.33%. The total output in June was 395,600 tons, and the total semi-annual output was about 2.15 million tons. 82.69% of national production lines).

4. Downstream

Since the beginning of the year, due to the epidemic, the downstream production of industrial rolling tanks has been greatly affected since the beginning of the year. From the refund and destruction of export orders to the continuous delays in the start of the factory, the overall order volume has been greatly affected. According to research, about 10% of industrial can rolling enterprises in Guangdong have declared bankruptcy. Until June, the overall demand for industrial rolling can orders was still small. According to Tianjin DX Can’s feedback, currently its annual orders are only about 60% of 19 years; in terms of food canning, because canned food is extremely popular in overseas markets, take Zhangzhou, China’s “canning capital” as an example. Zhangzhou's export value of canned goods in March was 57.13 million US dollars and weighed 43,527 tons. The value and weight of the canned goods increased by 9.8% and 11.3% year-on-year respectively. The overall food canning export was relatively stable. Domestically, the monthly orders of steel mills such as BG, WG and TY, which mainly produce food-grade canning materials, have basically increased steadily, while downstream orders have remained relatively stable.